Section 1: Q4 2019 Outlook

Globalization Has Changed the Global Economy. Are We Now in a Period of De-Globalization?

Our investment approach is focused on the expected behavior of asset classes in various economic environments. Our research shows that in addition to five broad economic environments – Growth, Stagnation, Inflation, Recession and Chaos – the global economy also experiences regime shifts, which are temporary, and regime changes, which are permanent. Globalization results in regime change, as does de-globalization. In this Fourth Quarter 2019 Outlook, we take a closer look at the current state of globalization. The recognition of this changing environment is critical in determining our investment positioning in 2020 and beyond.

Economic theory suggests that globalization benefits the world economy. The absence of trade barriers should allow each country to specialize in the production of goods and services in which they are relatively efficient, leading to global productivity gains.

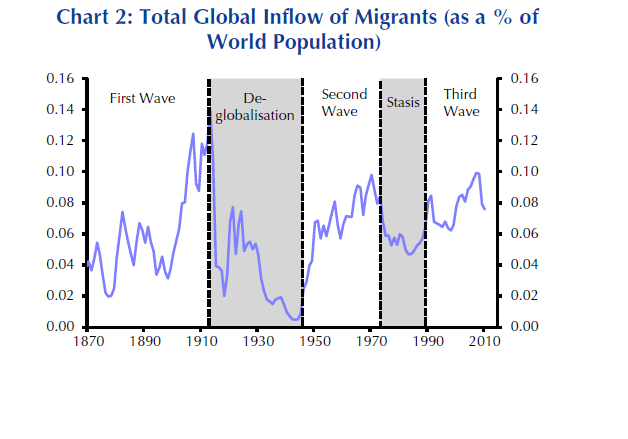

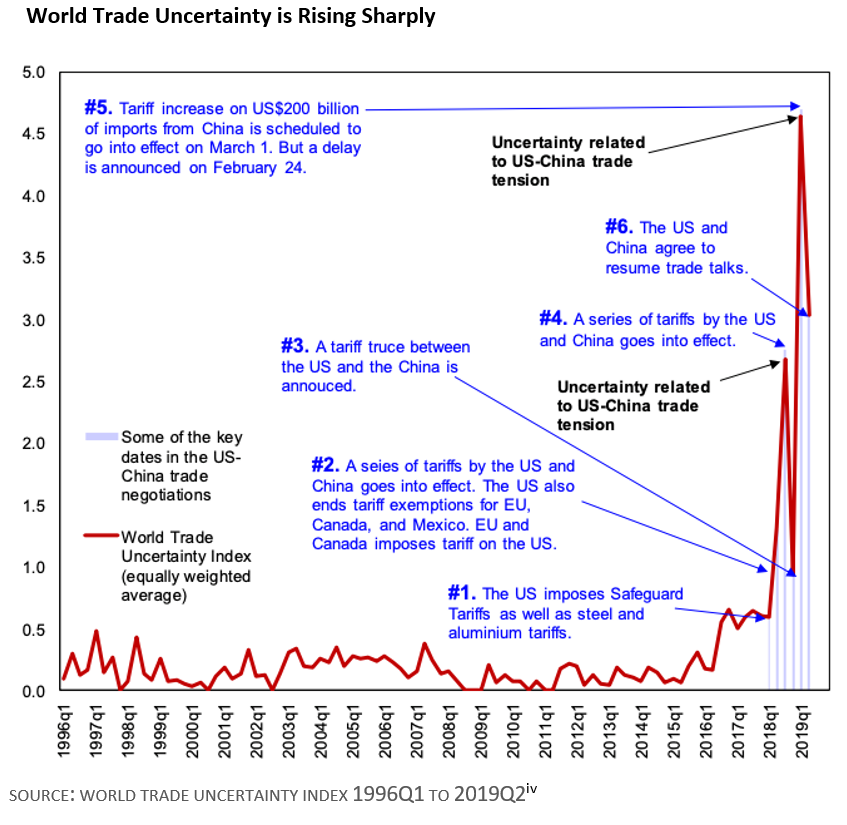

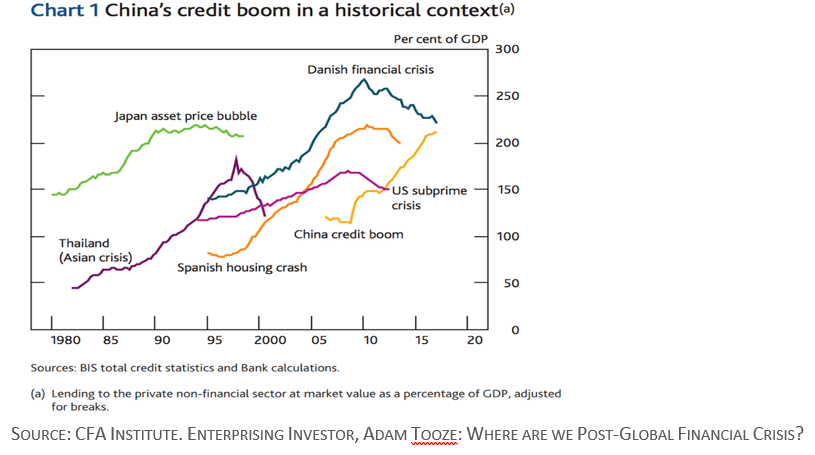

History shows that waves of globalization are driven by both technology and policy, but protectionist shifts tend to end them. In some cases, like in the 1970s, a pushback by policymakers can cause globalization to stall. In more extreme environments like the experience of the 1930s, a sustained policy backlash can push globalization into reverse. So far, the current trade war looks more like a stall but the risk of a de-globalization outcome similar to the 1930s is rising.

SOURCE: DEMIG (2015), OUR WORLD IN DATA, CAPITAL ECONOMICS

It takes a large and sustained push by policymakers to cause a period of de-globalization. As we begin Q4, the global economy is facing two dangers. The first is that a global economy that is already injured by geopolitical conflicts, including trade wars, endures further negative shocks. The second is that we overestimate resiliency and the feedback loop of slower growth that is occurring in many major economies around the globe.

This is occurring as the U.S. House of Representatives initiates a preliminary inquiry as to whether to proceed with a formal impeachment investigation of President Trump, China potentially delays trade solutions until the 2020 Presidential election, and the deadline for a Brexit decision falls at the end of October. Each of these challenges to the global economy could potentially be prolonged.

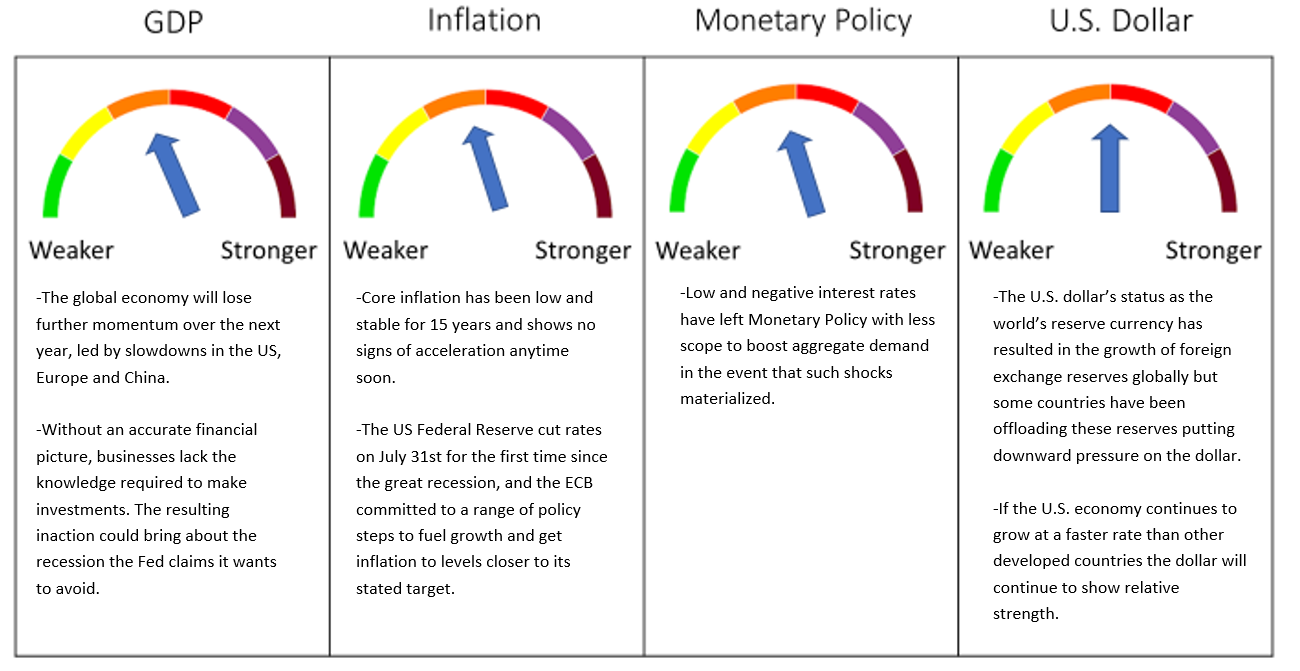

Compounding these risks, interest rates worldwide remain low or negative. It is estimated that over 80% of sovereign debt is trading with negative real rates.i While the U.S. Federal Reserve Bank continues to manipulate the economy with artificially low-interest rates, this policy is likely to backfire as the Federal Reserve’s policies mask the true state of the economy. Without an accurate financial picture, businesses lack the knowledge required to make investments. The resulting inaction could bring about the recession the Fed claims it wants to avoid. In addition, the idea that sub-zero interest rates lower the cost of borrowing has not proven to bring about the anticipated economic stimulus that central banks initially anticipated. Instead of paying banks to hold their money, businesses and individuals will find other sources in which to put their money.

Time to Include Gold in our Portfolio Models. Gold is Negatively Correlated with Interest Rates.

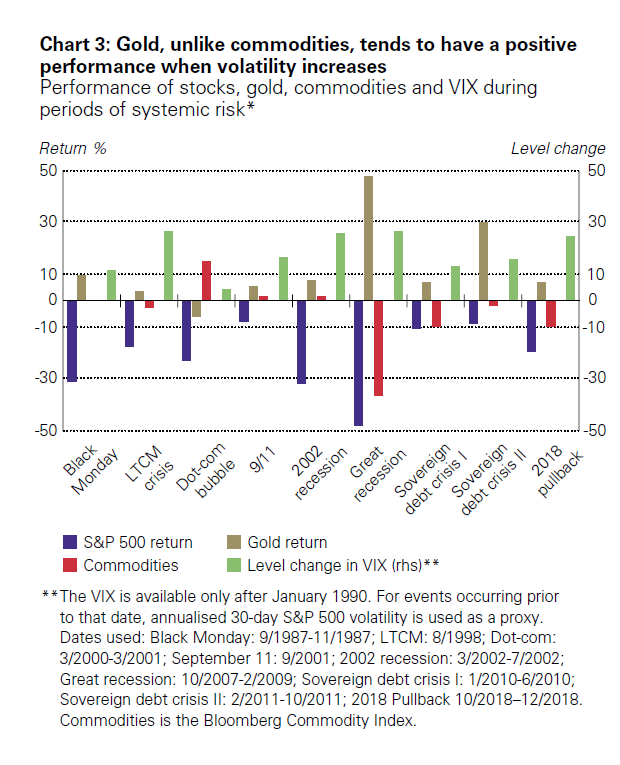

Economic events can create structural shifts in the acceptance level of risk. The global financial crisis of 2008-2009 is one example of these structural changes, referred to in our modelling as Chaos. Looking back at events including Black Monday, the LTCM crisis, and the global financial crisis of 2008 – 2009, World Gold Council analysis shows that gold mitigated portfolio losses incurred by investors during almost all tail events under consideration. For example, investors in the U.S., Europe, and the UK, who held a 5% allocation to gold reduced losses by approximately 5% during eight tail risk events.ii

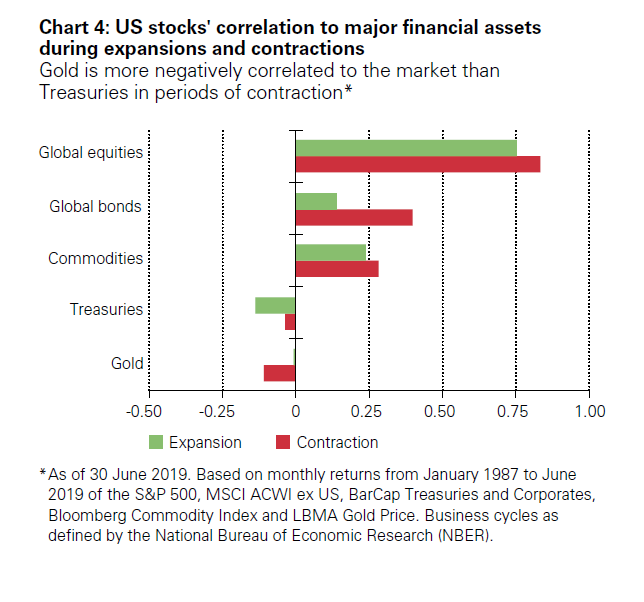

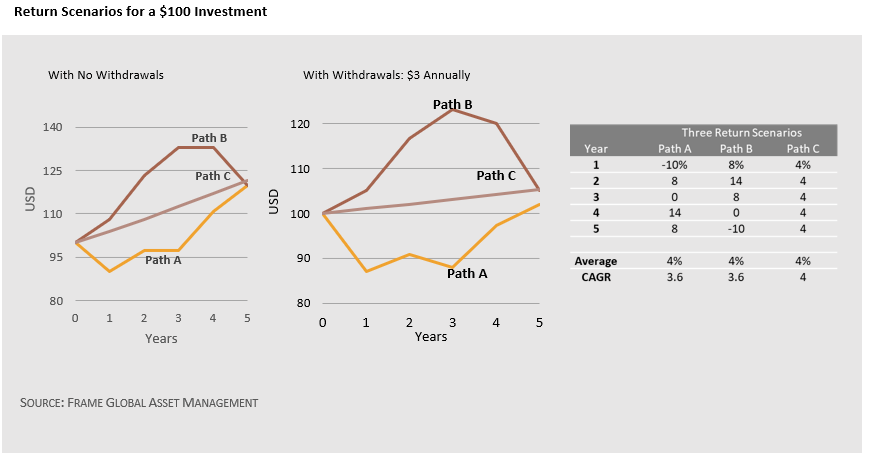

Our Portfolio Models are seeking exposures that offer low correlations among stocks and bonds to mitigate downside risk. In a year marked by noticeable geopolitical unrest, policy uncertainty and the risk of an impending recession, gold becomes a preferred investment to bonds and equities. And while one of the negatives of holding gold is that it does not generate income and has a cost to store it, the periods when bonds have a negative carry momentum become strong periods for gold.

During September, global monetary policy continued to influence gold price performance as many central banks around the world cut rates or expanded quantitative easing measures. The Federal Reserve cut rates by 25 basis points in July, and again in September.iii

Gold has important diversification properties that are evident during periods of systemic risk. Gold has little or no correlation with many other assets, including commodities, during times of stress. In addition, the correlation is dynamic, changing across economic cycles to the benefit of investors. Like other commodities, gold is positively correlated to stocks during periods of economic growth when equity markets tend to rise. Gold is negatively correlated with other assets during risk-off periods, protecting investors against tail risks and other events that can have a significant negative impact on capital or wealth – a protection not always present in other commodities. As a result, gold can enhance portfolio stability and improve risk-adjusted returns.

Many Central Banks are Adding to Gold Reserves

Analysis of several factors that are propelling the gold market include central bank gold demand. Physical gold is expected to play an important part as countries shore up their havens, both on the private and official levels. While gold no longer plays a direct role in the international monetary system, central banks and governments still hold extensive gold reserves to preserve national wealth and protect against economic instability. Today, gold is the third largest reserve asset globally, following U.S. dollar and Euro-denominated assets.iv Gold is increasingly used as collateral in financial transactions, much like other high-quality liquid assets such as government debt.

History shows us that central bankers were net sellers 30 years ago. These same banks have turned to buying gold since 2010, culminating more than 650 tons of bullion bought from the official sector in 2018 with the trend persisting through the first half of 2019.v This is more than at any time since the end of the gold standard.

We expect that central banks will continue to power gold’s move higher and beyond the current supply and demand dynamics. The October 2019 report from the World Gold Council notes that investors have begun to turn to gold to escape an environment of negative interest rates as treasury yields come under continuing pressure. The U.S. 30-year Treasury acts as a signal here. Should the 30-year U.S. bond fall into negative territory, as has already happened in Germany and France, we expect gold to hit new cycle highs.

With rates likely to stay low and geopolitical unrest unlikely to abate, the demand for gold exposure is expected continue.

SOURCE: BLOOMBERG, WORLD GOLD COUNCIL

SOURCE: BLOOMBERG, WORLD GOLD COUNCIL

Section 2: 4 Themes

Theme 1: Global Trade and GDP are Deteriorating

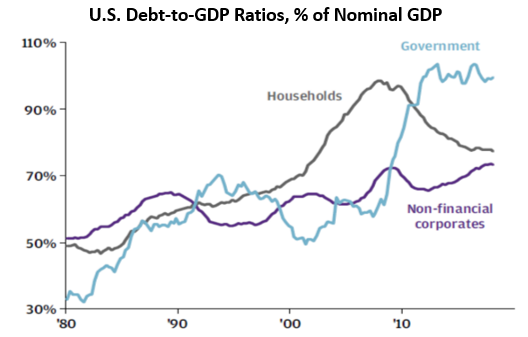

The multilateral trading system remains the most important global forum for settling differences and providing solutions for the challenges of the 21st century global economy. Trade conflicts heighten uncertainty, leading some businesses to delay the productivity-enhancing investments that are essential to raising living standards. Trade conflicts can also heighten political tensions and occasionally physically aggressive behaviors between countries.

The World Trade Organization Lowers Trade Forecast as Tensions Unsettle Global Economy

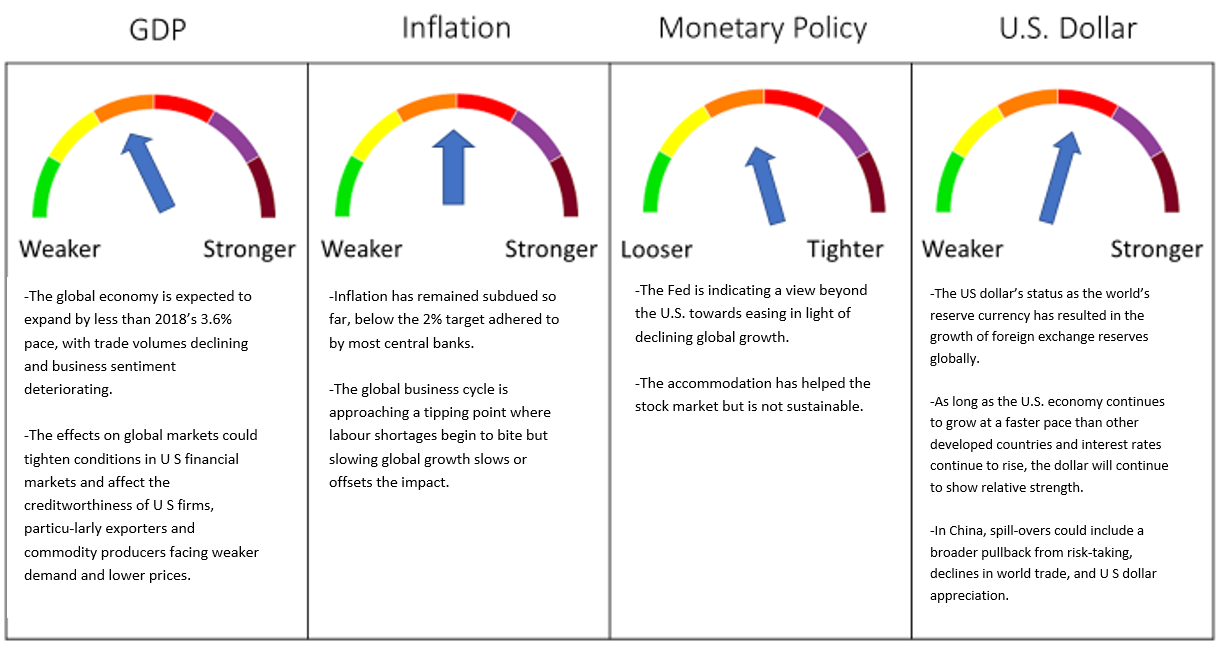

Escalating trade tensions and a slowing global economy have led WTO economists to sharply downgrade their forecasts for trade growth in 2019 and 2020. World merchandise trade volumes are now expected to rise by only 1.2% in 2019, substantially slower than the 2.6% growth forecast in April.vi The updated trade forecast is based on consensus estimates of world GDP growth of 2.3% at market exchange rates for both 2019 and 2020, down from 2.6% previously.vii Slowing economic growth is partly due to rising trade tensions but also reflects country-specific cyclical and structural factors, including the shifting monetary policy stance in developed economies and Brexit-related uncertainty in the European Union.

The projected increase in 2020 is now 2.7%, down from 3.0% previously.viii The economists caution that downside risks remain high and that the 2020 projection depends on a return to more normal trade relations. Risks to the forecast are heavily weighted to the downside and dominated by trade policy. Further rounds of tariffs and retaliation could produce a destructive cycle of recrimination.

Shifting monetary and fiscal policies could destabilize volatile financial markets. Continued slowing of the global economy could produce an even bigger downturn in trade. In addition, a disorderly Brexit could have a significant regional impact, mostly confined to Europe.

US Economy Starting to Feel the Pain

More recently, increased foreign competition has been blamed for U.S. manufacturing job losses over the past twenty years. In practice, while the integration of several billion workers into the global economy has contributed to both a loss of manufacturing jobs and a more general squeeze on labour’s share of income in the developed world, most academics agree that other factors, including technological change, have played a bigger role.

The U.S. economy posted strong gains in the first half of 2019, although some measures were negative. Consumer spending surged in the second quarter, supported by the strong labour market. The decline in interest rates over the summer tees up for U.S. consumers to be the key driver of activity in the second half of the year. Companies continue to hire, and the unemployment rate recently hit a 50-year low.ix Labour market tightness is finally translating into a pickup in wages. Business sentiment has deteriorated amid unrelenting uncertainty about trade. Business investment fell in the second quarter for the first time in three years and exports sagged with the weakness concentrated in the manufacturing sector. While fundamentals are still positive for the consumer, the government’s protectionist policies pose risks to the outlook. The persistence of healthy labour-market conditions, as well as efforts by several central banks to shore up an expansion that’s already passed the 10-year mark, will provide support to the global economy. Another tranche of tariffs on Chinese imports coming into effect in mid-December will hit U.S. consumers.

Open borders tend to boost productivity at a global and national level (particularly for developing countries). However, globalization has distributive consequences within economies. Workers and capital owners in competitive export-orientated industries tend to gain, while consumers’ purchasing power rises from access to cheaper imports. But relatively inefficient domestic industries can lose out to more productive foreign competition.

Our current outlook does not see any material improvement over the next twelve months.

Theme 2: Brexit and the EU: Deal or No-Deal?

The prolonged and twisted saga of Brexit has been a weight overhanging global markets since 2016. UK growth was synchronized with its main trading partners in 2015 but slowed following the 2016 Brexit vote from a range of 2.0- 2.5% to around 1.5-2.0% in 2017.x This occurred despite a clear strengthening in global activity. Throughout the latest phase the labor market has held strong and helped consumers to keep the economy from stagnating. The realistic prospect of no-deal since the change in prime minister has combined with a regional growth slowdown to produce a collapse in business confidence and signs in some of the leading surveys that the labor market is about to weaken. The domestic drag began to stabilize in 2018 after the initial purchasing power shock from the weaker currency peaked. Later in 2018, growth among the UK’s main trading partners slowed and growing complications in the Brexit negotiations prompted a phase of outright decline in UK business spending. Since the referendum UK business investment has weakened by almost 10% compared to capex in other developed markets. Given that UK investment was growing faster than elsewhere prior to the vote.

In a major blow to Prime Minister Boris Johnson, Britain’s highest court ruled in early October that his decision to suspend parliament for five weeks in the crucial countdown to the country’s Brexit deadline was illegal. And unresolved is a legal and operational solution including the Irish border backstop. Currently, there are no border posts or physical barriers between Northern Ireland and the Republic of Ireland. The backstop is designed to ensure that this continues after the UK leaves the EU. The backstop would only be needed if a permanent solution to avoid border checks could not be found. If it was needed, the backstop would keep the UK in a close trading relationship with the EU to avoid checks altogether.

If the sides fail to reach a deal, Mr. Johnson could be forced to seek a third Brexit extension. That’s because MPs have passed a law – known as the Benn Act – that requires Mr. Johnson to ask for a Brexit delay by October 19. This will push the deadline back from October 31 to January 31, 2020. MPs say the law is necessary in order to prevent a no-deal Brexit.

These events unfolding in the UK have the potential to impact European markets and beyond. Regardless of the outcome of Brexit, there is no doubt that the trading relationship between the EU and Great Briton has changed While many Dutch politicians say they dread the economic repercussions of the looming Oct. 31 Brexit deadline, the Netherlands is working to minimize the damage, in part by attracting some of the organizations and businesses that have already fled the United Kingdom.xi

SOURCE: NETHERLANDS FOREIGN INVESTMENT AGENCY

Theme 3: Low and Negative Interest Rates: A Dilemma for Central Banks and the Aging Population

Many central banks reduced policy interest rates to zero during the global financial crisis to boost growth. Ten years later, interest rates remain low in most countries. Core inflation has been low and stable for 15 years and shows no signs of acceleration anytime soon.

The U.S. Federal Reserve cut rates on July 31 for the first time since the Great Recession, and the ECB committed to a range of policy steps to fuel growth and get inflation to levels closer to its stated target. The minutes to the September FOMC meeting show that the Committee held a range of views with respect to both the appropriateness of the September rate cut and to what the Committee should communicate about the future direction of rates. The majority who wanted a cut last month cited trade policy uncertainty, slowing global growth, low inflation, and risk management as motivating considerations. Several participants favored leaving policy rates unchanged and argued policy should respond more to the data than to risks. Some argued that cutting too much now would leave monetary policy with less scope to boost aggregate demand if such shocks materialized.

The two major central banks were among a dozen that eased policy rates to combat the negative spinoff from rising trade tensions and political turmoil. The Bank of Canada was an outlier, staying on the sidelines as Canada emerged from a six-month slump in economic activity. And there is still no firm line of sight on how the UK will leave the European Union. Given these tensions, it will once again fall to extraordinarily stimulative monetary policy to sustain global growth, as few governments have committed to providing fiscal support.

Savings Gluts Provide Fuel for Low Rates

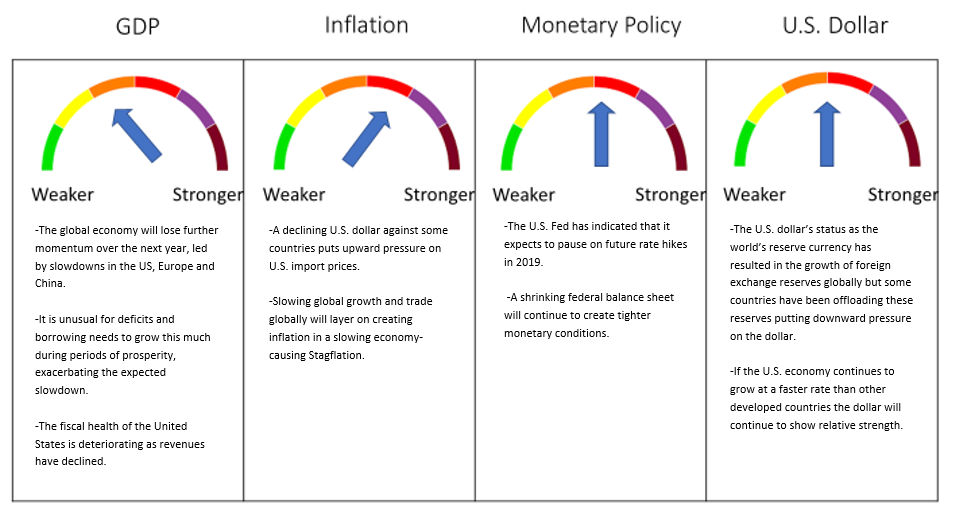

From the demand side, as populations age, they have a propensity to save. Prior to 2005, the global saving rate was never above 24.5%. Since then it has only been lower during the panic of 2009. The rate equaled its record high of 26.7% in 2018. This works out to roughly $21 trillion saved every year.xii Since many seek to match the investments in their savings to their life expectancies, they tend buy bonds.

The savings glut is leading to massive bond buying that is resulting in yields dropping below the inflation rate nearly everywhere in the developed world. Only two countries in the developed world have real 10-year yields above zero: Portugal and Italy.xiii Everywhere else, older people are buying bonds and driving yields below the inflation rate. Demographics tells us the developed world is not running out of old people anytime soon. The savings glut will continue.

While the global economy has been recovering, future downturns are inevitable. Severe recessions have historically required 3–6 percentage points cut in policy rates. If another crisis happens, few countries would have that kind of room for monetary policy to respond.

Theme 4: ETFs have a Positive Role in Market Volatility and Liquidity

Passive investing has historically attracted criticism, typically focused on illiquidity. The liquidity of ETFs varies due to characteristics determined by their underlying markets and indexes. The underlying markets for equity ETFs and credit ETFs are fundamentally different. In addition, apart from the underlying securities in an ETF, there are multiple layers of liquidity in the primary and secondary ETF markets, and the liquidity should never be less than that of the ETF’s underlying holdings. This is a superior feature compared to mutual funds.

ETF market makers and authorized participants looking for arbitrage opportunities trade dynamically to balance the supply and demand for ETF shares and their underlying assets. One of the key features of ETFs is that the supply of shares is flexible. Shares can be created or redeemed to offset the changes in demand. This structure has two important functions: it creates liquidity for the ETF shares by meeting the supply-and-demand needs of investors who trade on an exchange; and it helps keep an ETF’s price per share close to the ETF’s net asset value (NAV).

Index vehicles may be price takers at a microeconomic level but help to set prices at a macroeconomic level. The arbitrage mechanism allows for authorized participants to factor into the price the impact of macro and geopolitical events that may not yet be reflected in the underlying securities when these events occur while the primary markets are closed due to time zones and holidays. Historical evidence is consistent with the idea that higher correlations today are not the result of passive indexing, but rather reflect the macro environment and common factor risks.xiv

Recently there have been liquidity events that have tested the mechanisms behind ETFs. A number of credible studies have concluded that the arbitrage mechanism associated with the create and redeem feature of ETFs in fact helps, rather than hinders market liquidity in these extreme events.xv xvi

Section 3. Investment Outlook

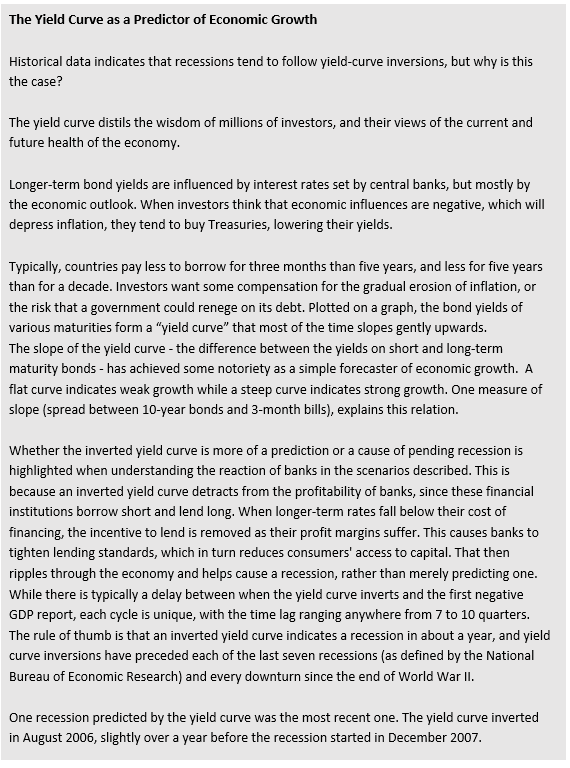

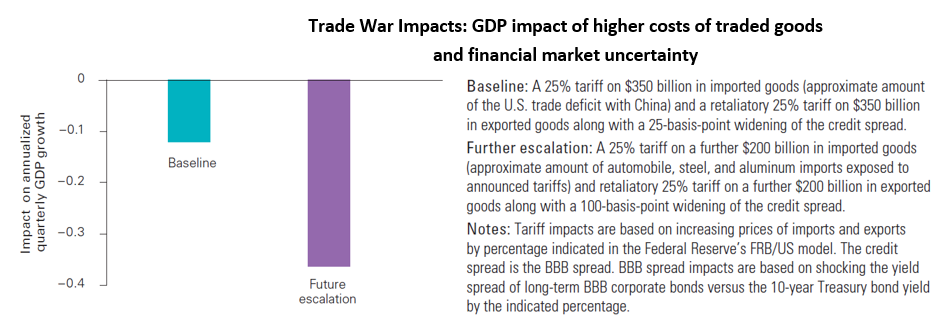

Slowing Global Growth and Inverted Yield Curves Leads Us to a Stagnation Forecast for the Next Twelve Months

SOURCE: FRAME GLOBAL ASSET MANAGEMENT

Frame Global Asset Management considers these trends and factors them into our outlook for the economy in our twelve-month forward period. We look back to periods of similar economic behavior and use this information to predict the future behavior of the asset classes that we consider. Our investment process allows us to adapt for non-traditional monetary policy and other exogenous variables.

Section 4. September 2019 Portfolio Models

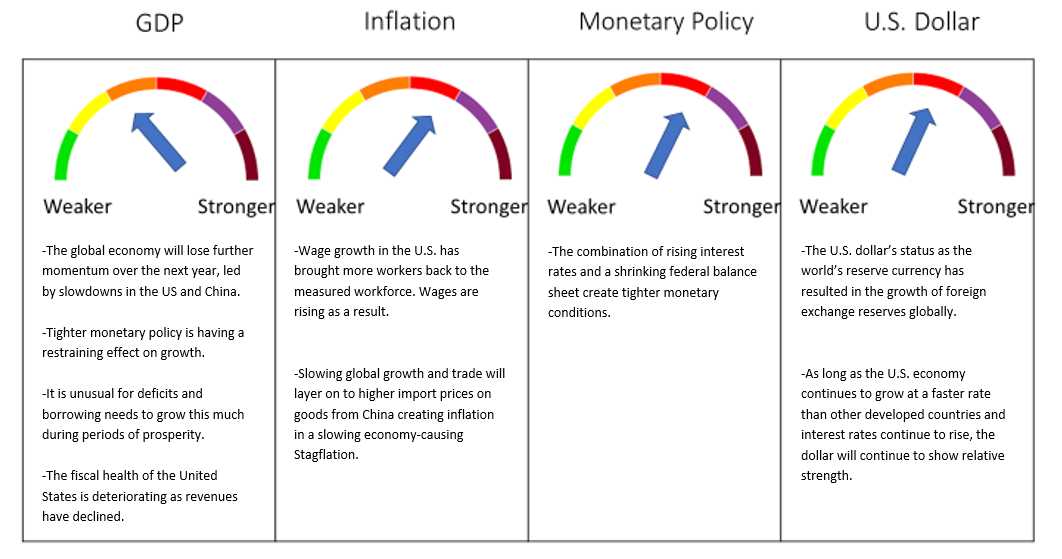

We have maintained our Stagnation outlook for the U.S. economy as growth is capped over our forecast time horizon of twelve months. While geopolitical developments have always played a role in economies and markets, their scale and impact has been steadily rising since the 2008 financial crisis. Against a hostile trade backdrop, the global economy is losing momentum. Forecasts for world GDP growth this year have fallen to 3.2% from the 3.9% economists expected a year ago. Inverted yield curves and slumping manufacturing activity that are traditional recession predictors are contributing to a cautious business mood. Few governments have committed to providing fiscal support, leaving extraordinary stimulative monetary policy as the tool of choice to combat the recession threat. Our concern is that central banks in several countries are operating at the limits of what monetary policy can do. This has negative feedback implications for fiscal policy and financial markets.

We will continue to monitor the data for growth, inflation, and recession signals from employment, consumer spending, business sentiment, Fed policy, the yield curve, inflation, and global economics. Our focus is on protecting portfolios from downside risk, and we believe that our investment process is working to achieve that goal.

Deborah Frame, CFA, MBA

President and Chief Investment Officer

October 14, 2019

iWorld Gold Council. Global Gold-backed ETF Flows. October 8, 2019.

iiWorld Gold Council. Gold and Tail-risk Hedging. January 2013.

iiiTrading Economics. U.S. Fed Funds Rate. September 19, 2019.

ivWorld Gold Council. Gold Versus Commodities. October 2019.

vWorld Gold Council. Gold Versus Commodities. October 2019.

viWorld Trade Organization. Press Release. October 1, 2019.

viiWorld Trade Organization. Press Release. October 1, 2019.

viiiWorld Trade Organization. Press Release. October 1, 2019.

ixTrading Economics. U.S. Unemployment Rate. October 4, 2019.

xJ.P. Morgan. Global Data Watch. October 11, 2019.

xiNetherlands Foreign Investment Agency (NFIA). More Brexit-impacted companies choose the Netherlands due to ongoing uncertainty. August 26, 2019.

xiiNational Accounts of OECD Data. Household Savings. 2019.

xiiiTrading Economics. Ten Year Yields. October 15, 2019.

xivMadhavan, A. and Morillo, D. “The Impact of Exchange Traded Funds: Volumes and Correlations.” The Journal of Portfolio Management. Summer 2018, 44 (7) 96-107.

xvMSCI. “Have High-Yield ETFs Created Liquidity Risk?” Reka Janosik. March 27, 2019.

xviAquilina, M., Croxson, K., Valentini, G. “Fixed income ETFs: primary market participation and resilience of liquidity during periods of stress.” Financial Conduct Authority. Research Note. August 2019.