Section 1: Q2 2021 Outlook

Now Is an Opportune Time to Make an Allocation to Global Macro Strategies

Global Macro is an investment style that is highly opportunistic and has the potential to generate strong risk-adjusted returns in challenging markets. Against a backdrop of the current pandemic, uncertainty, and potentially increased volatility, we felt it would be timely to share our insights on the approach and explain why we believe now could be an opportune time to make an allocation to Global Macro Strategies.

The impact of the macro-economic environment is different among different asset classes and changes over time. Global Macro driven investment decisions are particularly important in high uncertainty/high volatility environments where macro factors exert a meaningful influence on asset pricing. These types of environments affect factors such as interest rate differentials, foreign exchange balances, and the consequent over and under valuation of asset classes and sectors, which may be exploited through nimble and tactical positioning.

Perhaps the most universally accepted concept of prudent investing is to diversify, yet this concept grossly oversimplifies the challenge of portfolio construction. The goal of diversified investment management is to earn the highest return while meeting the risk tolerance criteria of an investor through asset allocation and selection. Asset allocation models can be defined as Conservative, Moderate Growth, Growth, and Aggressive Growth or by Defensive, Defensive Balanced, Balanced, Balanced Growth, and Growth. Regardless of the labels, the risk profiles for these models are mandated to reflect the risk tolerance of the clients who invest in them.

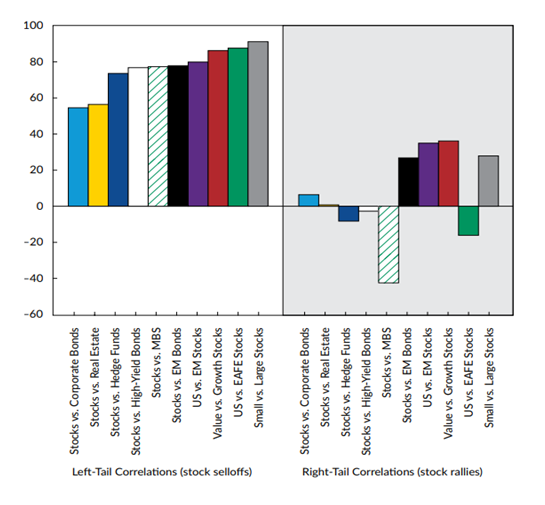

When asset classes are combined in a portfolio, the amount and direction of each change over time will benefit or hurt the overall risk of the portfolio. Correlation is a statistic that measures the degree to which two variables move in relation to each other. In optimal portfolio allocation, if all stocks tend to fall together as the market falls, the value of diversification is lost. Negative correlations describe a relationship between factors that move in opposite directions. Negative correlations are of particular interest in the financial world since negatively correlated assets move in opposite directions. Asymmetric correlation occurs when correlations behave differently in negative environments than they do in positive ones. Correlations between asset classes, measured over the full sample of returns, have been found to demonstrate this behavior.

Diversification Disappears When it is Most Needed

Numerous studies that have examined correlation asymmetry support a finding of the undesirable variety: characterized by high positive correlations among asset classes in negative markets when low and negative correlations are needed, and low or negative correlations in upside markets when high and positive correlations are needed.i ii iii However, Global Macro strategies exhibit appealing downside correlations relative to equities, bonds, and other hedge fund strategies. This can be well understood given Global Macro’s lower exposure to systematic liquidity risk and systemic deleveraging risk.

Portfolio Construction: Manage Portfolio Correlations Rather Than Static Asset Allocation

SOURCE: PAGE, SÉBASTIEN AND PANARIELLO, ROBERT (2018). “WHEN DIVERSIFICATION FAILS.” FINANCIAL ANALYST JOURNAL. VOL. 74, NO. 3.

Asymmetries in upside and downside correlations have also been found to exist between stocks in a single market, as well as across markets internationally.iv The “neutral” asset allocation of 60% of a portfolio held in stocks and 40% in cash, bonds, and other financial assets that does not adjust will experience asymmetric correlations in negative markets, as will asset allocation ranges above and below 60/40. Asymmetric correlations also have similar implications in risk management when looking at the behavior of bonds.

Frame Global Asset Management uses a Global Macro approach. We consider the outlook for the global economy relative to a view of expected U.S. GDP growth in the twelve months ahead. The outlook falls into one of our five broad descriptions: GROWTH, STAGNATION, RECESSION, INFLATION and CHAOS, allowing for a transitioning in the period from one environment to another as well as recognizing total regime shifts. (See White Paper 2).v

We define Growth, Stagnation, Inflation, Recession and Chaos as the following:

Growth: U.S. Real GDP growth greater than 2.5%

Stagnation: U.S. Real GDP growth between 0 and 2.5%

Inflation: U.S. CPI greater than 3.5%

Recession: U.S. Real GDP less than 0%

Chaos: All asset classes exceed a correlation threshold

In doing this, we can recognize the changing correlations among asset classes and adjust when they change. The historical monthly return data of over forty asset classes is tagged using rules to assign each month with one of the five environments. From this tagging, expected return distributions are created by drawing from twenty years of return data using bootstrapping (random sampling with replacement) from past economic environments that are similar to what is anticipated in the coming twelve months. The twelve-month forward outlook and updating of expected return distributions is updated monthly.

We Measure What Matters: The Degree to Which a Given Asset Diversifies the Main Growth Engine When It Underperforms

Our own research shows that when historic data for asset classes is partitioned under these broad economic environments, patterns of behavior emerge. This allows us to create portfolios using ETFs that are the closest proxy to the asset classes that are used in the modelling process. Using ETFs, we can specifically address expected returns among the asset classes being considered while also addressing the probability of negative returns in those asset classes in the anticipated economic environment.

Global Macro investments tend to perform best in high uncertainty/high volatility environments where macro factors exert a meaningful influence on asset pricing. We believe today’s markets will remain in a state of disequilibrium over the next year, making current asset valuations increasingly fragile.

It is not enough to evolve a portfolio within equities or fixed income in environments where all equities or all bonds are highly and positively correlated or correlated with each other. In these environments, it is important to recognize the correlations and the lack of diversification benefit. In these negative return environments, it is important to have permission, within investment policy across the risk sensitivity spectrum of clients, to shift to low and negatively correlated asset classes. This involves the consideration of global equities as well as broad fixed income and market capitalization.

The current environment seems to be one in which Global Macro is well positioned for successful portfolio management.

Section 2: Four Themes

Theme 1: Greater Global Co-Operation

A meeting of central bankers and finance ministers from 19 of the world’s largest economies plus the European Union – the G20 – was held in early April to discuss issues facing the global economy.vi

• The G20 acknowledged the improved global economic outlook due to vaccination campaigns and continued policy supports, especially in advanced economies, while focusing on the uneven recovery across and within countries. It committed to protect those most impacted, including “women, youth, informal and low-skilled workers.”

• The G20 extended the Debt Service Suspension Initiative (DSSI) until end-2021, recognizing the unique challenges faced by low-income emerging markets (EMs). 46 countries have requested debt relief worth $12.5 billion. The new extension would cover an estimated $9.9 billion in bilateral debt payments.

• The G20 called on countries to “develop forward-looking strategies regarding climate change and environmental protection, investing in innovative technologies and promoting just transitions toward more sustainable economies.” Climate change took a backseat during the Trump era but is likely to retake center-stage in future post-pandemic meetings.

• The Group talked about reforming the WTO. This is important because the pandemic has accelerated protectionism, increased deglobalization pressures and made countries more inward-looking.

• The G20 also called for cooperation for a “globally fair, sustainable and modern international tax system.” A global minimum corporate tax would allow the U.S. to raise additional revenue from U.S.-based European companies and other multinationals.

Theme 2: Inflation Threat Brewing

We define an Inflationary environment as periods when the year-on-year realized CPI increases beyond 3.5%. Central banks globally generally target 2%. For decades, inflation has not been a problem in developed markets. Both monetary and fiscal policy have contributed to economic circumstances that are disinflationary, rather than inflationary, resulting in lower and less volatile inflation.

Today, inflationary regime change concerns point to four factors.

First, there has been an unprecedented increase in money creation. US M2 has grown by $4.2trn, from $15.5trn to $19.7trn in one year (to February 2021).vii

Second, there has been extraordinary fiscal accommodation that needs to be financed. The Congressional Budget Office (CBO) estimates a U.S. fiscal deficit of $3.1trn in 2020, or 15% of GDP. The CBO forecasts the deficit will shrink to $2.3trn in 2021, or 10% of GDP. In the entire modern history of the US, there have only been two instances of consecutive double-digit deficit years.viii

Third, the bond market is signaling increased inflation as long-term yields have recently increased.

Fourth, the inflation derivatives market is pricing in a 31% probability that the average inflation rate will exceed 3% over the next five years.ix High and volatile inflation creates uncertainty, thus harming the ability of companies to plan, invest, grow, and engage in longer-term contracts. Moreover, while firms with market power can increase their output prices to mitigate the impact of an inflation, many companies can only partially pass on the increased cost of raw materials, shrinking margins.

U.S. core inflation currently stands at 2.6%.x Due to the uncertain pace of recovery from the pandemic, we are not yet forecasting an inflation environment in the next twelve months.

Theme 3: Higher Interest Rates and a Stronger Dollar Have Weighed On Gold

Gold is considered to be an effective hedge against inflation, but this has not happened in 2021. Following price weakness in the first two months of the year, the gold price extended its decline in March. Gold finished March at US$1,691.1/oz., down over 10% y-t-d, its weakest quarterly performance since Q4 2016, and 18% below the record US$2,067/oz achieved in early August 2020.xi Gold’s performance has been weak across major currencies.

Recent analysis suggests gold’s current performance is consistent with the onset of previous reflationary periods. Analysis indicates that the primary driver of gold’s decline during March, and throughout Q1, was higher interest rates, impacting the opportunity cost of holding gold. While expectations of higher inflation kept building, the continued bond sell-off pushed nominal and real yields on sovereign debt higher during the month – with the 10- year Treasury yield seeing its sharpest rise in thirty years. Gold’s increased sensitivity to interest rates is a headwind in the short term, but the recent increase in interest rates is expected to level off as central banks continue to use monetary policy tools to keep them in check. Some central banks, including the Reserve Bank of Australia and European Central Bank (ECB), have increased bond purchases when local yields increased, while both the Federal Reserve and the Bank of England have signaled a continuation of their current asset-purchasing plans and level of target rates.xii

Despite the intense focus on rising yields during the quarter, the overall level of yields is structurally low. As a result, investors continue to shift their asset allocations from traditional high quality, low yielding bonds to assets which offer higher potential returns, but simultaneously have higher volatility.

Investors will eventually face elevated levels of risk (a driver of gold investment demand) in the short to medium term as markets continue to assess how monetary and fiscal strategies play out. The differing approaches to control higher yields taken by central banks around the world are likely to contribute to heightened risk as well. For example, the rising yield gap between the U.S. and Europe could put further pressure on the ECB and the stuttering economic recovery in the latter.

The reflation trade will also lead to the uneven performance of equities. Recent stimulus measures have flooded capital markets with liquidity, pushing financial asset valuations ever higher. Historically, gold has also underperformed commodities in the early stage of a reflationary period but tended to catch up and outperform in the longer term.

As investors look to guard against these risks, we expect gold will find further support in its role as a portfolio hedge.

Theme 4: U.S. Market Cap Rotation

The announcement of a vaccine for COVID-19 and the implementation of a series of fiscal and monetary stimulus plans to support a recovery in the U.S. economy has resulted in the more domestically focused small- and mid-cap segments of the U.S. equity market outperforming large caps. While this has occurred, the ownership of this space is largely domestic.

Mid- and small-cap U.S. equities represent a significant piece of the global market. The S&P Mid Cap 400 and S&P Small Cap 600 are benchmarks for U.S. mid and small caps. Over the past 20 years, they have outperformed the S&P 500, as well as a majority of actively managed U.S. equity funds in their respective size segment.xiii

The size and liquidity of mid- and small-cap U.S. equities are substantial in the context of global comparisons. At the end of 2020, the S&P Mid Cap 400 had a market capitalization similar to the entire French stock market, while the U.K.’s stock market, the largest in Europe, was roughly the same size as the mid- and small-cap indices combined.xiv

The prior outperformance of mega caps means that now, smaller companies have the potential to act as important diversifiers. The largest U.S. company by market capitalization, Apple, has risen from a 3% weight in the S&P 500 (as of December 2015) to a 6% weight at the end of Q1 2021, larger than the combined weight of 158 smaller constituents. Added to other “Big Tech” titans of Microsoft, Amazon, Alphabet, Facebook, and Tesla, just six companies compose 22.2% of the index, outweighing the 350 smallest names in aggregate.xv

We expect to see relative outperformance in the mid and small market cap sectors as we recover from the pandemic impacted market.

Section 3. Investment Outlook

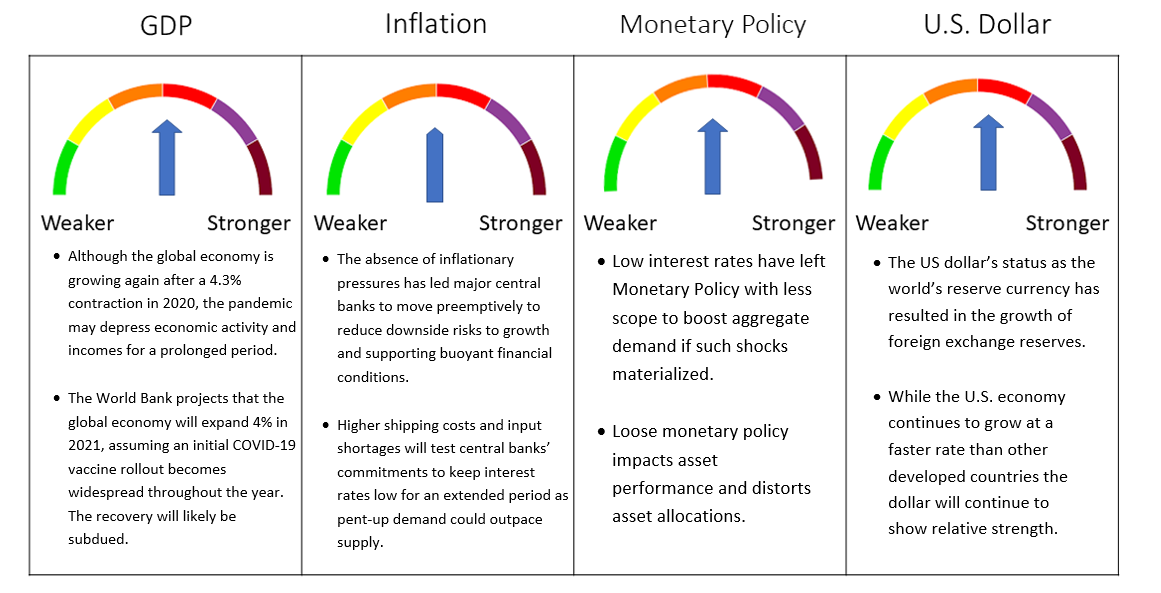

Global Pandemic Leads Us to a Growth Forecast for the Next Three Months Followed by Nine Months of Stagnation

SOURCE: FRAME GLOBAL ASSET MANAGEMENT

Frame Global Asset Management considers these trends and factors them into our outlook for the economy in our twelve-month forward period. We look back to periods of similar economic behavior and use this information to predict the future behavior of the asset classes that we consider. Our investment process allows us to adapt for non-traditional monetary policy and other exogenous variables.

Section 4. March 2021 Portfolio Models

The macroeconomic outlook continues to improve, and the recovery may be faster than one that typically follows a business cycle recession, as vaccination rollouts accelerate, and the US$1.9 trillion stimulus package has been signed into law. This has prompted a surge in inflation expectations and commodity prices and a bond sell-off.

At this point in the recovery, households have used lockdown savings to pay down debt – particularly credit cards – while holding onto cash for precautionary reasons, causing demand to be suppressed. Our twelve-month forward outlook remains at three months of Growth, followed by nine months of Stagnation, as we have seen evidence of a stronger short-term recovery rebound but a lingering longer-term impact on employment and output.

Equity exposure across all models reflects our view that markets are looking through the uncertainty of the pandemic and towards the resumption of more normal life once populations are vaccinated. In March, we maintained the asset allocation that we established in February. We continue to include some exposure to gold as a stabilizer in this volatile environment. Shorter duration fixed income has been maintained as the U.S. economy normalizes and inflationary pressures are rising.

The economic reopening and the global stimulus that is underway will lead to improved household liquidity, a wealth effect from rising asset values and lower consumption, healthy consumer balance sheets, and a healing labor market.

Deborah Frame, CFA, MBA

President and Chief Investment Officer

April 14, 2021

iThe Myth of Diversification Reconsidered. MIT Sloan School Working Paper 6257-21. William Kinlaw, Mark Kritzman, Sebastien Page, David Turkington. February 2021.

iiThe Myth of Diversification. The Journal of Portfolio Management. David B. Chua, Mark Kritzman, and Sébastien Page. Fall 2009.

iiiAsymmetric Correlations of Equity Portfolios. Andrew Ang, Columbia University and NBER Joseph Chen, Stanford University. March 2002.

ivThe Myth of Diversification Reconsidered. MIT Sloan School Working Paper 6257-21. William Kinlaw, Mark Kritzman, Sebastien Page, David Turkington. February 2021.

vFrame Global Asset Management. White Paper 2. January 2016.

viG20 Communications. FSB. April 7, 2021.

viiTrading Economics. U.S. M2 Money Supply. February 2021.

viiiThe Best Strategies for Inflationary Times. Henry Neville, Teun Draaisma, Ben Funnell, Campbell R. Harvey, and Otto Van Hemert. April 4, 2021.

ixThe Best Strategies for Inflationary Times. Henry Neville, Teun Draaisma, Ben Funnell, Campbell R. Harvey, and Otto Van Hemert. April 4, 2021.

xTrading Economics. U.S. CPI. March 2021.

xiWorld Gold Council. Gold Market Commentary. April 2021.

xiiWorld Gold Council. Gold Market Commentary. April 2021.

xiiiS&P Dow Jones. Hidden in Plain Sight. Tim Edwards, Sherifa Issifu. April 2021.

xivS&P Dow Jones. Hidden in Plain Sight. Tim Edwards, Sherifa Issifu. April 2021.

xvS&P Dow Jones. Hidden in Plain Sight. Tim Edwards, Sherifa Issifu. April 2021.